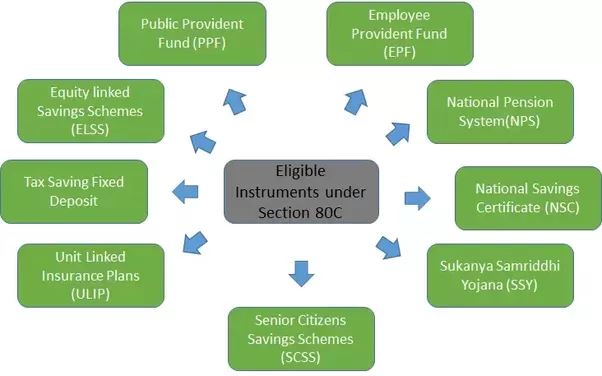

Investing in tax planning schemes is a priority for most individuals as well as HUF taxpayers who can claim a deduction up to Rs.1.5 lakh every year on their taxable income. This deduction is available on investments and expenses under Section 80C of the Income Tax Act, 1961. Apart from making investments in Public Provident Fund (PPF), mediclaim and term life insurance, you can also consider tax saving mutual funds for the purpose of tax planning.

Tax saving mutual funds, most commonly known as ELSS funds (Equity Linked Saving Schemes) are diversified equity mutual fund schemes which qualify for deductions under Section 80C. ELSS comes with a lock-in period of three years from the date of investment, which is the lowest considering every tax free investment option. If you make an invest in ELSS funds through a systematic investment plan or SIP, each investment will be locked in for three years from its respective investment date and will earn you good tax-free returns as well.

Importance of ELSS funds

Investments in ELSS mutual funds are eligible for a tax deduction up to Rs.1.5 lakh under Section 80C of the Income Tax Act, 1961. For instance, if you fall under the topmost tax bracket where tax obligation is 30%, ELSS investment of Rs.1.5 lakh can help you save up to Rs.45,000 of your tax obligation. The total cap on deductions allowed under Section 80C is Rs.1.5 lakh.. The total amount invested in ELSS funds will be eligible for deduction from your income tax before calculation of tax.

Also, from 1st April, 2018, long-term capital gains or LTCG earned on the transfer of equity mutual funds with 65% or more equity exposure will be required to pay a 10% tax on LTCG above Rs.1 lakh per year. This means if you make a long-term capital gain of Rs.1 lakh or more per year, you will have a 10% tax obligation on your LTCG. But, the LTCG made till 31st January, 2018, however, will remain exempt from any tax obligation.

Top 5 Reasons to Invest in ELSS Mutual Funds

In case you are still confused regarding the benefits of opting for tax saving mutual funds over traditional tax saving investment options, following are the top 5 reasons to invest in ELSS mutual funds.

- Lowest Lock-in Tax Saving Investment Option:

Tax-saving investment options generally feature a long lock-in period which currently varies from 3 years to 15 years. During this lock-in period, you will not be able to redeem your investment or make withdrawals except for some specific emergency issues. The PPF or Public Provident Fund comes with a lock-in period of 15 years which requires you to stay invested for a really long period of time. Also, a tax saver FD or Fixed Deposit comes with a lock-in period of at least 5 years.

Currently, ELSS, or tax saving mutual funds, have the shortest lock-in period of 3 years which enables you to divert your funds to a different investment option within a shorter period of time if your investment is not performing as per your expectations. So, making an investment in Equity Linked Saving Scheme enables you to redeem your invested amount with returns after a lock-in period of 3 years.

- Investing through SIPs:

SIP or systematic investment plans allow you to invest in equity mutual funds over a long-term by investing in small installments over regular intervals of time without affecting your monthly or annual budget. SIP is also recommended for individuals who face trouble saving money as the amount gets auto-debited from your bank account over regular intervals. Systematic Investment Plan helps investors to inculcate a habit of saving rather than a habit of spending. The best SIP plans also provide the benefit of rupee cost averaging to its investors to earn maximum returns over their investments.

- Flexibility to Choose Investment tenure:

Tax Saver Mutual Fund Schemes come with a lock-in period of 3 years. Other traditional tax-saver investment options come with a block of 5 years or more beyond the initial lock-in period. But, ELSS schemes allow you to stay invested for a day or even several more years post completion of the initial 3 year lock-in period. You can continue investing in any of the top mutual funds on offer with better compounding benefits.

- Diversify and Switch Funds:

Diversification helps you to build your own portfolio by investing in different mutual funds as per your requirement. It allows you to invest across the market in various companies from different sectors. You can also diversify across fund houses and investment styles by putting your money in more than one ELSS mutual fund. Not only this, you can also check the returns of various SIP mutual funds to check how the mutual fund scheme is performing. You can also check the returns on various mutual fund schemes using SIP Calculator for returns.

- Inflation Beating Returns:

ELSS is a market-linked diversified equity scheme which gives it an edge over fixed return investments that offer tax benefits. Other traditional tax saver investment options like PPF do not consider inflation which results in reducing the actual returns earned by these investments. Tax saver mutual funds provide higher returns which beat the impact of inflation in the long-term making it the best tax saving investment option.